What Is Commodity Backed Cryptocurrency, and How Does It Work?

Do you know what commodity backed cryptocurrency is? No? Don’t worry! We are here to help you!

Let’s start from the beginning. Stablecoins were invented in order to make the cryptocurrency market more stable.

Interestingly, there are several types. We need to mention that commodity backed stablecoins are one of the most well-known types of stablecoins.

How does commodity backed stablecoins work? Let’s find out!

It is important to understand how they work. They achieve the promise of stability by tying themselves to real-world assets. For example, gold, silver, etc.

The value of a stablecoin relies on the holder’s trust in the collateralized reserve asset. We need to note that the platform is required to declare its solvency in order to keep the value of the cryptocurrency.

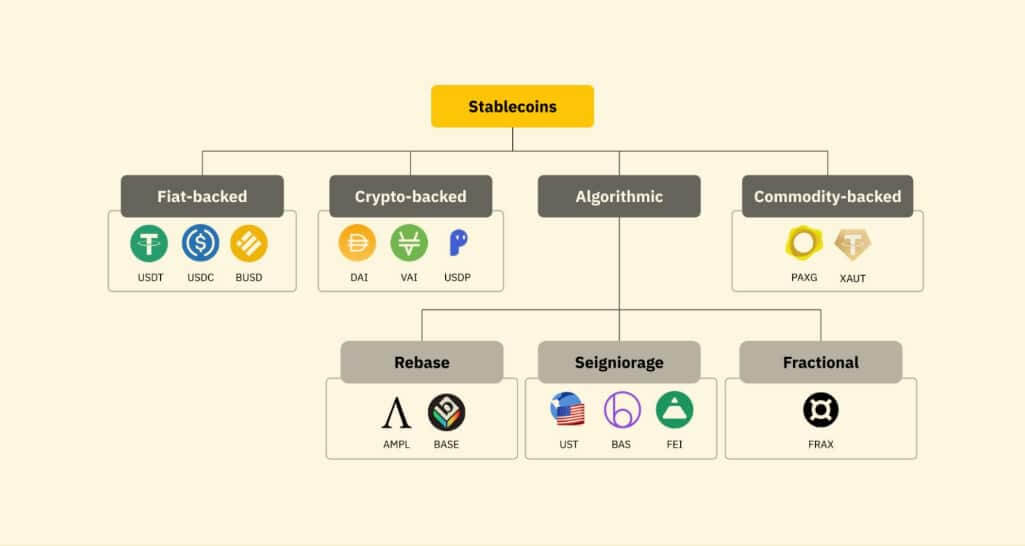

Types of stablecoins

As stated above, there are a number of types of stablecoins; more precisely, there are three of them: fiat backed, crypto backed, and the last one isn’t hard to guess. The third one is commodity backed stablecoins.

The above-mentioned stablecoin is backed by a physical asset. Interestingly, there are various physical assets, such as gold, silver, etc.

Let’s learn more about commodity backed cryptocurrency.

The purpose of commodity backed cryptocurrencies is to offer greater access to investors who would like to invest in cryptocurrency but want something more trustworthy.

Important cryptocurrencies

There are thousands of cryptocurrencies. Let’s focus on several popular cryptocurrencies.

Ethereum is the second-largest cryptocurrency in the world after Bitcoin, even though it lags behind the dominant cryptocurrency by a significant margin.

Have you heard about Tether (USDT)? It was one of the first as well as most popular of a group of so-called stablecoins.

Because the vast majority of cryptocurrencies have experienced frequent periods of dramatic volatility, Tether, and stablecoins, in general, attempt to reduce price fluctuations in order to attract users who may otherwise be cautious. The price of the above-mentioned altcoin is tied directly to the price of the U.S. currency.

Interestingly, USD Coin is also tied to the price of the greenback using fiat-collateralized reserves.

The above-mentioned stablecoin was launched in 2018 by the Centre Consortium. Interestingly, the Centre Consortium consists of Coinbase and Circle.

Commodity backed cryptocurrency and new opportunities

Do you know what makes commodity backed cryptocurrencies so interesting to investors?

Compared to fiat currencies, they are less susceptible to inflation, as they are less volatile compared to fiat money.

You also need to remember that they are less liquid compared to other crypto and fiat currencies.

Although they are difficult to liquidate, commodity backed stablecoins are way safer compared to other forms of stablecoins.

As stated earlier, they are less volatile. Moreover, they are often used as payment methods. As tangible assets back commodity backed stablecoins, commodity backed stablecoins are less volatile compared to traditional cryptocurrencies.

Furthermore, they also allow investors to purchase hard-to-source assets. For instance, physical gold is quite expensive. Thanks to a commodity backed stablecoin, investors have the opportunity to access the benefits of physical gold without the costs. Also, they don’t have to worry about other issues.

Several types of commodity-backed stablecoins

We can start with Pax Gold (PAXG.)

It is an asset-backed token where one token represents one fine troy ounce of gold which is stored in LBMA vaults.

Interestingly, PAXG is built as an ERC-20 token on the Ethereum blockchain. It is worth noting that the New York State Department of Financial Services regulated Paxos Trust Company which is the parent company of PAXG.

Let’s take a look at SilverTokens (SLVT.) As in the case of PAXG, it is an ERC-20 token on the Ethereum blockchain. Thanks to the token mentioned above, you can own silver – digitally.

Interestingly, the physical silver is stored in more than 10 private vaults in politically neutral countries. Richard Malik founded SLVT. His goal is to make silver more popular.

We shouldn’t forget about Platinum Coin as well. As in the case of Pax Gold and SilverTokens, Platinum Coin is based on the Ethereum blockchain.

Platinum Coin is a private asset. So, no personal information is needed in order to buy and sell Platinum Coin.

Perspectives

A commodity backed cryptocurrency has the potential to change the world. Thanks to stablecoins, it is easier to invest in various assets. For example, it is easier to invest in gold bars as well as other assets.

It is no secret that gold and other precious are pretty expensive. There are other issues as well. As a result, it isn’t very practical to own tangible assets.

However, it is possible to solve various issues. How? Commodity backed stablecoins.

As you already know, cryptocurrencies are extremely volatile, to say the least. It is quite hard to keep an eye on the market for a long period of time. Hopefully, commodity backed stablecoins are less volatile compared to traditional cryptocurrencies.

Also, they are safer than other forms of stablecoins. Besides, they are less susceptible to inflation compared to fiat currencies.

Did you know that commodity backed stablecoins were previously inaccessible to small investors? Yes, there was a time when small investors weren’t able to access stablecoins.

It is desirable to read more about all the main types of stablecoins in order to understand how all of them work. Moreover, it is important to understand the difference between them.

[the_ad id="24160"]